Investing in stocks can be scary for beginners but with the right approach, anyone can get started and grow their wealth over time. In this post I’ll walk you through the basics of how to get started investing in stocks as a beginner, sharing my own experiences to help you avoid the common mistakes. Let’s get started!

What is the Stock Market?

The stock market is where publicly traded company shares are bought and sold. When you invest in stocks you are buying ownership in a company. As the company grows and makes money so does your investment. But stocks can also decrease in value if the company does poorly, so understanding how the stock market works is key before investing.

My First Stock Investing Experience

When I first started investing in stocks I was clueless. I had no idea where to start and I didn’t know how much to invest. I had heard of people making millions in the stock market but I also knew the risks. Through experience, I learned some valuable lessons that I’ll share in this post to help you avoid the same mistakes.

Step 1: Learn About Stock Investing

Before you start stock investing, you need to learn. The more you know about how the stock market works, the better your decisions will be for long-term success.

How to Learn Stock Market for Beginners

- Read Books: There are hundreds of books on stock investing. Some of the best ones are “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton Malkiel. These books will give you the basics of stocks and investing.

- Take Online Courses: Platforms like Coursera and Udemy have courses on stock investing for beginners. These courses will teach you the basics and strategies to grow your portfolio.

- Follow Stock Market News: Keep up with financial news and trends in the stock market to stay informed about what’s happening in the market.

My Experience with Learning Stocks

I spent months reading books and consuming content from experts before I made my first investment. I wanted to make sure I had a good understanding of the risks and rewards before I put my money into the stock market.

Step 2: Know the Risks of Stock Investing

One of the things I learned early on is that stock investing involves risk. Stocks can be volatile and prices can move big time based on market conditions, company performance, and economic trends. Anyone new to stock investing should know these risks.

Stock Investing Risks

- Market Risk: This is the risk the entire market will go down and all stocks will be affected.

- Company Risk: Individual companies can perform poorly or go out of business and their stock will drop or become worthless.

- Liquidity Risk: If a stock is illiquid you may not be able to get out when you need to.

How to Minimize Risk in the Stock Market for Beginners

When I started investing I was careful to diversify my portfolio. I invested in many companies from different industries to spread the risk. I also didn’t invest more than I could afford to lose.

Step 3: Choose the Right Brokerage Account

To buy stocks you need to open a brokerage account. A brokerage account is a type of account that allows you to buy, sell, and hold investments like stocks, bonds, and mutual funds. Many online brokers make it easy for beginners to start stock investing.

How to Choose a Stock Broker for Beginners

- Low Fees: Some brokerage accounts charge fees for every trade you make. Look for brokers that offer low or no commission fees.

- User-Friendly Platform: Choose a broker with a platform that is easy to use if you’re just starting out.

- Educational Resources: Some brokers offer educational tools and resources to help you learn more about stock investing.

My Experience with a Broker

When I started I went with a well-known online broker that offered commission-free trades. This way I didn’t have to worry about the fees eating into my returns. And the platform was easy to use so the whole process wasn’t as scary.

Step 4: Start Small

You should start small when you’re a beginner. You don’t need to put a lot of money upfront. In fact, it’s better to start with an amount you can afford to lose while you’re learning.

How Much to Invest in the Stock Market for Beginners

- Set a Budget: Decide how much you can invest without it affecting your daily life.

- Consider Fractional Shares: Some brokers allow you to buy fractional shares, so you can invest in a portion of a share for companies with high stock prices like Amazon or Google.

My First Investment

When I first started investing in stocks I started with a small amount – a few hundred dollars. I wanted to dip my toes in without risking too much of my savings. Over time as I gained more experience and confidence I increased my investment amounts.

Step 5: Diversify Your Portfolio

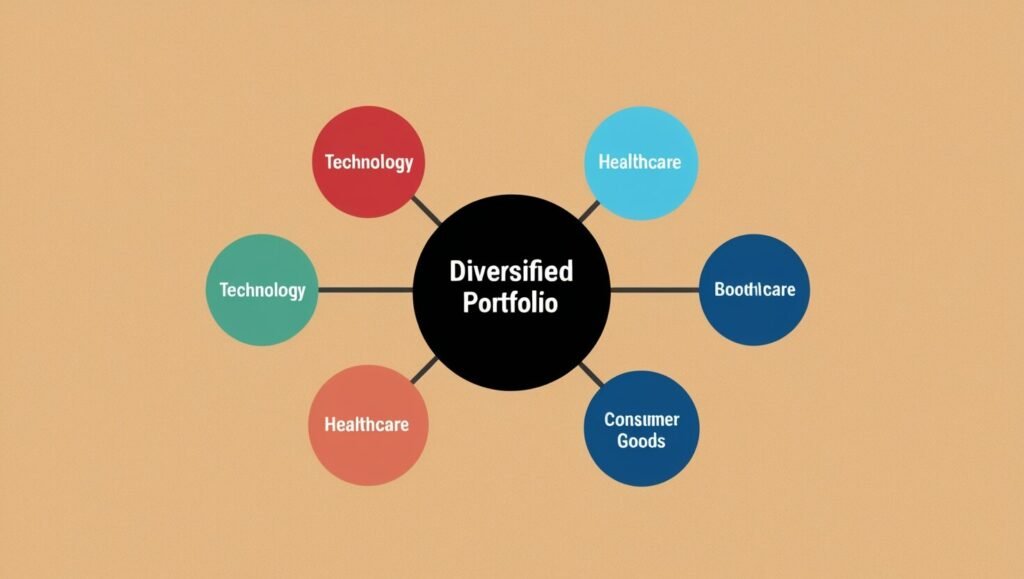

One of the rules of stock investing is diversification. This means spreading your money across different types of investments to reduce risk. When one investment fails another may succeed and balance out your portfolio.

How to Diversify Your Stock Portfolio for Beginners

- Invest in Different Sectors: Don’t put all your money in one industry. Instead invest in different sectors like technology, healthcare, and consumer goods.

- Include Different Asset Classes: Along with stocks consider investing in bonds or ETFs to diversify your portfolio.

- Don’t Put All Your Eggs in One Basket: Investing in just one or two stocks is risky. The more diversified your portfolio the better.

My Diversification Strategy

I used to invest too much in one company. It worked out but I soon learned the importance of diversification. Now I invest in multiple industries to reduce my risk.

Stay Consistent and Patient

Stock investing is a long-term game. Don’t try to time the market. Consistency is key to building wealth through stock investing.

Why Patience is Important for Beginners

- Don’t Panic Sell: Stock prices will go up and down, and it’s easy to sell when prices drop. But panic selling will result in losses.

- Stick to Your Plan: Create a plan and stick to it. Don’t let short-term market movement distract you from your long-term goals.

My Experience with Patience

There were times when I was tempted to sell during a market downturn, but I reminded myself that investing is a long-term strategy. By staying patient, I avoided unnecessary losses and allowed my investments to recover and grow.

Keep Learning and Adjusting

The stock market is always changing, so keep learning as you invest. Whether it’s through reading, taking courses, or following trends, stay informed and you’ll make better decisions.

Continuous Learning for Stock Market Beginners

- Stay Current: Follow the news and keep up with economic and company news.

- Adjust Your Approach: As you get more experience you may want to adjust your investment approach.

My Ongoing Learning

I still learn new things even after years of investing. The stock market is unpredictable and staying informed helps me ride the ups and downs with ease.

Conclusion

Starting to invest in stocks as a beginner doesn’t have to be scary. Follow these steps and learn from my mistakes and you’ll be set for success in the stock market. Remember it’s a long-term commitment so be patient, keep learning, and most importantly start small and build from there. Happy investing!

Using the focus keywords “Investing in Stocks,” “Stock Market for Beginners,” and “How to Start Investing in Stocks as a Beginner” this guide is SEO friendly and easy to read. Stay consistent, diversify, and keep learning.

FAQs

How do I start investing in stocks?

Open a brokerage account, start with a small amount, and diversify your investments.

How much money do I need to begin?

You can start with as little as $100, or even less with fractional shares.

What are fractional shares?

Fractional shares let you buy a portion of a stock, ideal for beginners with limited funds.

What are the risks of stock investing?

Stocks can fluctuate, and you may lose money. Diversifying reduces this risk.

How do I choose a good stock?

Research companies you understand, and focus on those with strong financials and long-term potential.